Editorial Board

February 28, 2018, 7:00 AM GMT+8

From

Not helping. PHOTOGRAPHER: JEFF SWENSEN/GETTY IMAGES

Does anyone, anywhere, support President Donald Trump's plan to impose tariffs on steel and aluminum imports?

As Bloomberg News recently reported, Trump is considering broad duties of as much as 24 percent on imported steel and 10 percent on aluminum, with the aim of protecting national security and pressuring China to reform its trade practices.

This is a terrible way to achieve either ambition. The likely outcome would be to raise prices, hinder growth, jeopardize jobs, burden taxpayers, encourage retaliation, and heedlessly destabilize the system of global trade. Not to be alarmist, but it could even raise the cost of beer.

The idea is so comprehensively misguided that it has induced a rare consensus in Washington. Most of Trump's cabinet opposes the idea, as does nearly every mainstream economist. Farm groups call it a "short-sighted mistake." Manufacturers call it "disastrous." Trump's own Economic Report of the President, which he has no doubt read carefully, warns that such barriers could "distort the free allocation of capital."

Surely steelmakers, at the very least, would be grateful for this added protection? Not so fast: Many producers are worried about the inflation, input shortages and supplier disruptions that could result, just as the industry's prospects are otherwise improving and a big infrastructure push is on the way. (Tariffs would only raise the cost of that worthy endeavor.)

Nor does the Pentagon think much of the national-security rationale. Total military demand for steel and aluminum amounts to only about 3 percent of domestic production, meaning that reliance on imports isn't a notable danger. Imposing broad tariffs, however, could have a "negative impact on our key allies," as Trump's defense secretary delicately put it.

China, meanwhile, won't be much affected by these measures. It's already subject to more than two dozen antidumping and countervailing duties on basic steel products, and hence provides less than 3 percent of total U.S. imports. About the only practical effect of broad new tariffs would be to invite retaliation on American exporters.

None of this is unfamiliar; none of it should be controversial. For decades, the U.S. government has tried now and then to protect the steel industry -- and those efforts have consistently harmed consumers, undermined manufacturers, inhibited growth and impeded innovation, all without obvious benefits. The most recent such initiative -- the so-called safeguards imposed by the George W. Bush administration in 2002 -- raised costs and destroyed roughly 200,000 jobs.

There's a better way. A different trade dispute has caught Trump's attention -- concerning intellectual property, and China's approach to transfers of corporate technology. On this issue, the administration is reportedly working with allies to jointly pressure China at the World Trade Organization. This is exactly the right approach: orderly, above board, and intended to minimize conflict. Given time, it may well work.

The same cannot be said for the president's tariffs. If he proceeds with this idea, he'll be harming the economy, not helping it.

Inflation can be your friend or your enemy depending on where you put your money.

Tangible investments such as Real Estate, Precious and semi precious metals, Diamonds, precious stones, Art, Antiques and rare coins will all rise.

Very bad move by trump Instead of making America competitive he has started a trade war.

Lawrence B. M. Bellefontaine has been making Asian and World economic and investment predictions with uncanny accuracy for the past 37 years.

His fellow hoteliers and travel agents laughed at this prediction. The Indonesian tourist bureau scolded him for making such a prediction.In 2017 that prediction came true.

Bellefontaine speaking to 200 Travel Agents in Beijing 2008

|

In 2014 after Bali never having a real estate downturn in modern history he shocked most of his huge following on his Bali News & Views Blog when he predicted the worst downturn in history after a government minister warned foreign investors, who were utilizing nominee agreements, a grey area of law, that they were illegal.

Since 2014 Bali real estate prices have dropped as much is 50%.

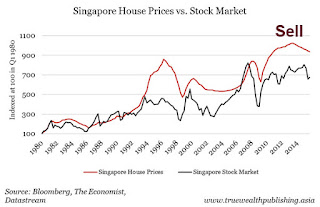

Singapore Real Estate Crash:

In the same year he predicted that Singapore real estate prices, which had soared with unconscious Chinese buying over several decades was about to end and that a real estate downturn had begun.

Since then Singaporean real estate has had almost four years of consistent downturn.

His predictions have been so accurate that a very jealous major news letter publisher in Bali once called him the "Nostradamus of Bali".

As he explains, I am not a Nostradamus. “I don’t make any predictions based on supernatural visions of the future. I base my predictions first on 40 years of real estate and tangible investment experience, 21 years of living in Bali, 13 years of being president and director of 135 staff, TripAdvisor Hall of Fame award winning hotel”

He stresses that “predictions and investment decisions should be based on three major sources of information.

(1) Fundamental analysis of what is the current and future expected supply and demand?

(2) Technical analysis. Is the market oversold or overbought?

(3) Economic conditions. What are the current economic conditions and what are the economic conditions expected in the future?”

During a recent Christmas, New Year ski vacation in Canada, he digested daily input from Canadian and American television news stations.

As one article points out. “But the proverbial bull is also celebrating a milestone of its own: The bull market in U.S. stocks turns nine years old on Thursday, March 9.

He has a 90% + accuracy record on predicting major shifts in the worlds real estate markets since 1982, over 35 years.

He has a 90% + accuracy record on predicting major shifts in the worlds real estate markets since 1982, over 35 years.As he says, “I came out of semi retirement because I believe that many Asian real estate markets, especially Bali, are going to surge in the next 3 to 10 years”.

As Bellefontaine says, “frankly I don’t know why anybody would want to live in Singapore, all it is one big shopping mall with few natural features to attract those wanting to retire”.

Speaking about retirement Bellefontaine points out that, “the largest demand for real estate throughout the world the next 5 to 10 years will be from baby boomers”. Boomers such as himself, born between 1940’s five and 1957 represent 25% of the world’s population and they are now retiring.

They will no longer need their big three-bedroom houses in places such as Sydney, America, Canada etc. because there is just the two of them. They now have opportunity to take their hard-earned cash and retire to a place where it’s a lot less expensive such as Bali, Vietnam, Thailand etc.

As he points out in his seminars if you look at Asia, which includes China, the largest country in the world, you can easily see that Bali is a short distance from every major country including Australia.

As he points out in his seminars if you look at Asia, which includes China, the largest country in the world, you can easily see that Bali is a short distance from every major country including Australia. There is an estimated 3 Billion people living within 5- 6 hrs from Bali. Twenty five percent of those are baby boomers about to retire.

As Bellefontaine points out, "you don't have to be a rocket scientist to figure this one out. Bali is about to have relations largest increases demands in history the next five years".

This makes Bali a perfect spot for Asian expatriates to retire, where the cost of living is 50% to as much as 70% less than their own country. Not only can they can enjoy good clean air, fresh vegetables, warm year-round temperatures but most importantly the wives will not ever have to do any domestic chores again with housekeepers costing as little as $250 per month.

As Bellefontaine points out, “the main reason that he moved to Bali 21 years ago was the local Balinese people who are friendly and honest.

Below is a quick analysis of where Bellefontaine predicts will be the best and worst real estate markets in 2018 and the next 3 to 5 years.

(1) China’s major cities real estate prices will probably not grow much and may fall after years of extraordinary increases.

(2) Hong Kong, which Bellefontaine calls, “the bitcoin of the real estate markets because of it’s soaring prices with no reason” may for the first time in decades begin to crash, because nothing makes financial sense.

(3) Australia who also has enjoyed a robust real estate market for years has already seen the beginning of a downfall with places on the west coast of Australia in Perth dropping as much is 20% to 30% in a few short years. He predicts that now, “perhaps Perth prices have levelled off they may start to increase very slowly”. Not so attractive for investors.

(4) On the other hand, he’s predicting that most major Australian cities such as Sydney, Melbourne, Brisbane will see significant declines in prices in 2018 because they are simply overpriced for the market.

(5) Singapore which he accurately predicted would crash three years ago may have bottomed out and may only see minor increases in 2018.

(6) Thailand, Lagos. Cambodia, and Vietnam should have good real estate markets in 2018 and beyond.

(7) Indonesia with the fourth largest population in the world has an internal demand from simple population growth and should see continued increases in prices in most areas. Jakarta, its capital city may not see much increases due to over supply at this time but should not see a downturn.

(8) Bali, which has just endured the first downturn in modern history going back as much as 70 years or more has already had a four-year downturn.

You may also start your search with their very high-tech website bestasiarealestate.com which allows you to search areas without a keyboard.

As he concludes so long as you can still buy a three bedroom 500 m² villa with private swimming pool for as little as $159,000 which rents out for $3,000 to $4,000 per month there are still excellent opportunities in Bali.

No comments:

Post a Comment